What the new US tariffs mean for your creative business

18th AUGUST 2025

We know the new US tariffs feel like yet another hurdle for your small business but you’re not on your own. Keep reading to learn what’s changed, how it affects your prices and the steps you can take to prepare.

What are the US import tariffs? What is the De minimis exemption? Is your business ready for the changes?

First up, a tariff is a tax on goods imported from one country to another. Usually, it’s a percentage of the item’s value. The US has imposed tariffs on most UK goods imported into the US. Until now, shipments to the US worth $800 or less could enter tariff-free thanks to something called the De minimis exemption.

However, on 30th July 2025, the US Government announced this exemption will end much sooner than planned — starting on 29th August 2025. So, from that date, even small shipments under $800 will face tariffs. This change was originally set for July 2027 but has been brought forward.

Big changes like this will affect almost every order you send to the US, whether it’s a £20 print, a £200 necklace or a £2,000 sculpture. We know this feels like a punch in the gut. Especially after everything we all experienced with Brexit and the never-ending to-do list! That’s why staying informed and finding simple ways to ease the impact right now is so important. So if you haven’t made any changes yet, take a deep breath, make yourself a cup of tea and read on to find out what the updates mean, and more importantly, what you can do about it.

The $800 ‘duty-free’ window that has now closed

Before: Parcels worth $800 or less benefited from the De minimis exemption.¹ This meant they could usually enter the US without customs duties, tariffs or complicated paperwork.

Now: Since the US Administration announced that starting from 29th August 2025, this exemption will end, it means that…

- Every shipment, big or small, must be declared at US customs.

- Shipments may be subject to duties and inspections.

- If you’ve been relying on sending small, low-value orders tariff-free, that’s no longer possible.

- Original artwork like paintings, limited edition prints or drawings may still be protected under federal law as ‘informational materials’, meaning that tariffs may not apply. This exception depends on proper classification (HS codes, Country of Origin).

- The UK Government guidance advises speaking to your carrier about any new customs requirements and rates.

This is a big change. The duty-free window has now closed yet the situation is still evolving. For the latest information or to find out more, visit business.gov.uk

Disclaimer: This isn’t legal advice and rules may change — so please check official sources before making decisions. Any mention of companies or services here is not an endorsement. We want to help you stay informed but need to state that we can’t take responsibility for how you use this information.

What is the 10% baseline tariff?

It’s a new import duty the US has introduced, meaning that from April 2025, almost all goods coming from the UK into the US are charged a flat 10% at the border. This is applied across the board, regardless of the product’s value and now also includes small, low-value parcels that were previously exempt.

- Current status: Since April 2025, nearly all UK-origin goods entering the US are subject to a flat 10% tariff.

- Before 29th August: Parcels under $800 were exempt due to the De minimis rule.

- After 29th August: Every shipment, even those under $800, is subject to at least the 10% tariff.

- Other sector-specific tariffs: Certain goods, like steel, aluminium and some vehicles, may face additional duties up to 25%.

- Cost implications: Small orders are disproportionately affected, as flat-fee penalties (where applicable) and baseline tariffs make low-value shipments expensive for US buyers.

Why knowing about the 10% tariff matters for your business

Knowledge is power. You need to understand how these tariffs work in order to decide your next steps if you sell to the US. For example, you need to consider...

- Pricing pressure: Your costs will need to increase for your US customers unless your business absorbs the cost of the tariffs. For very low-cost items, even a small duty or flat fee can double or triple the delivered price.

- Customer experience: Surprising buyers with unexpected import charges can damage trust and increase returns. Transparency in shipping costs and duties is critical.

Read on to find out your options…

What your next steps could be

1. Know your product’s tariff category

Every product has a 10-digit HS code (also known as a commodity code) that determines the tariff rate. You need to get this right — the wrong code can mean overpaying, delays or even seizure at customs. Help is available from the UK Government’s ‘Check duties and customs procedures’ tool or a trade adviser.² Find out more information here.

2. Rethink your US pricing

A £100 sale is worth £90.91 after a 10% tariff if you don’t change your price. You need to decide: will you absorb this, share the cost or pass it on? If you work with wholesale or retail partners, you might want to revisit your agreements so that costs are clear.

3. Get your paperwork watertight

Customs documentation (classification, origin, declaration) must be accurate. Mistakes can cause delays, fines or goods being held. Consider help from export consultants, freight forwarders or organisations like UK Export Finance.

4. Use the most cost-effective shipping solution

With postal services like Royal Mail: Most shipments are sent on a Delivered Duty Unpaid (DDU) basis. This means your customer will be asked to pay any tariffs, import duties, taxes (like VAT or GST) and handling fees once the package arrives in their country — before customs will release it. This can sometimes come as a surprise and may affect your customer’s experience.

You can help manage customer expectations by clearly communicating about potential tariffs. Consider adding a note on your website or sales platform, including information in your product descriptions, or contacting customers directly. For example, a simple message like, “Please be aware, this item may be subject to tariffs when shipped to the US” can make a big difference.

With commercial carriers like UPS or FedEx: These companies often offer a Delivered Duty Paid (DDP) option. With this, you can pay tariffs and taxes upfront when you buy the postage.

If you decide to cover import duties and tariffs upfront for your customers, it’s important to factor those extra costs into your pricing.

Understanding these options will help you decide how to price your products and explain shipping costs clearly — making the buying process smoother and more trustworthy for your US customers.

5. Keep an eye on trade news

Tariff rules can change. Some higher ‘reciprocal’ tariffs were paused for 90 days in mid-2025 while negotiations continued. Check business.gov.uk to stay updated.

The bottom line

From 29th August, tariffs on most UK goods heading to the US are very much real — starting at 10%. Sadly, the ‘duty-free’ days are behind us. It’s a big change but being aware and planning ahead will help you take control and keep your business moving forward.

What the US tariffs mean for your business: key takeaways…

New rules can feel overwhelming, but knowledge really is power. With a little planning, you can stay in control and keep selling to your US customers with confidence. Just remember…

1. Every order — big or small _ now faces tariffs:

The $800 duty-free window has closed. From now on, even low-value parcels will be subject to a 10% baseline tariff when entering the US.

2. Pricing and paperwork matter more than ever:

Check your product’s tariff code, review your US pricing and make sure customs documents are watertight to avoid costly delays or mistakes.

3. Choose the right shipping option and be transparent:

Whether you let customers pay duties on arrival or cover them upfront, clear communication is key. Setting expectations will protect trust and loyalty.

Images:

1 Purple Leather Coin Purse, Natthakur

2 USA The American Road Trip Felt Pennant Flag, The Pennant People

3 Origami Paper Money

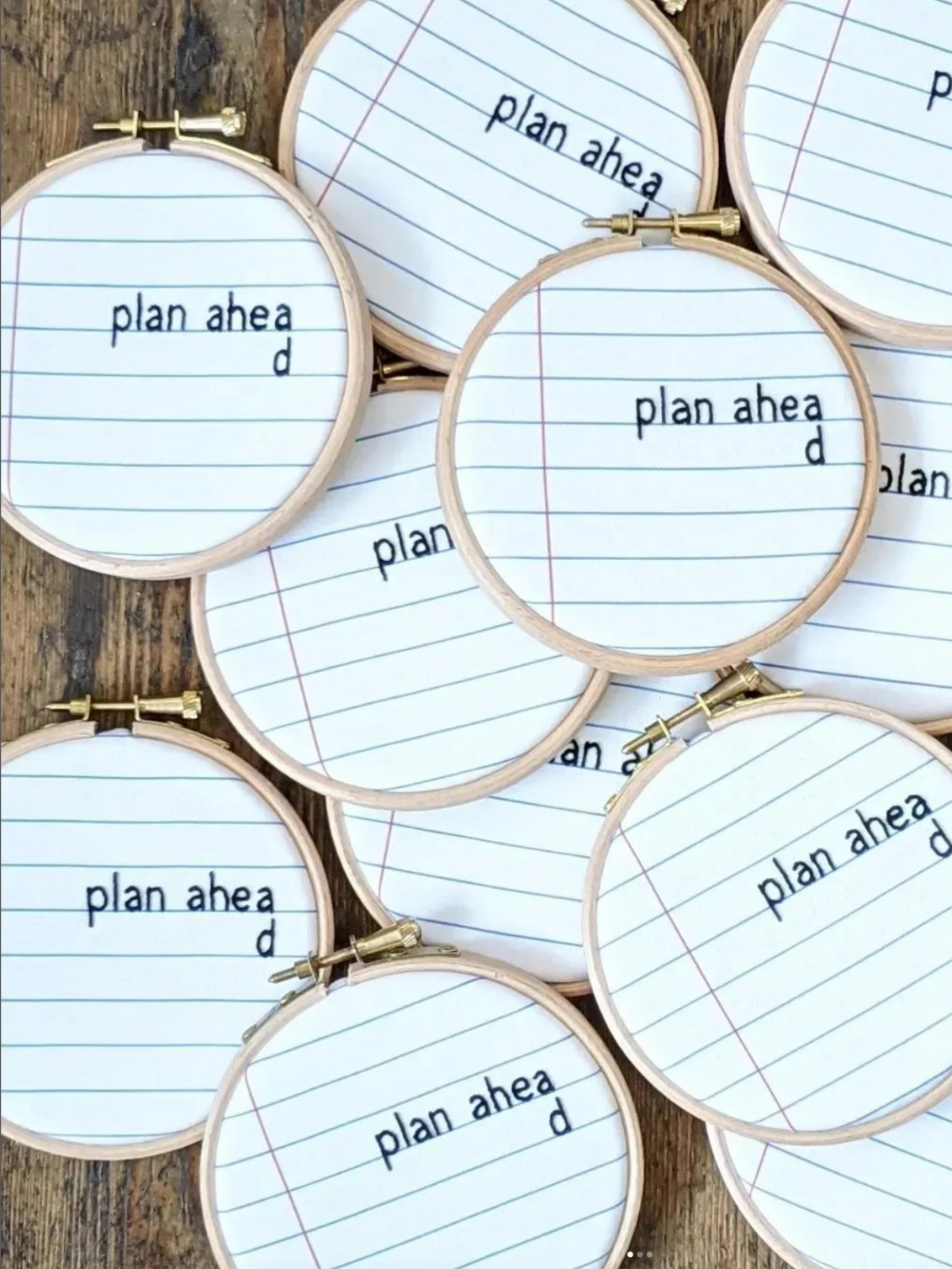

4 Plan Ahead Embroidered Hoop, Little Light Stitchery

5 First Class Business Supporter Sticker, Holly & Co

6 The Master Plan Notebook, The Old English Company

Sources:

1. What is a De minimis exemption? It’s a rule that lets shipments below a certain value enter a country without extra taxes or customs fees. This helps simplify trade and reduces admin for both businesses and customs officials. Different countries set different value limits.

2 'Finding commodity codes for imports into or exports out of the UK', Gov.uk

Related Content

More inspiration for you

Simple tech tools, add-ons and gadgets to help small businesses

Where and how to sell your products and services

Is your tech sustainable? 5 points for small businesses to consider

Scaling your business while preserving the magic

The cost of living impact on small businesses: should you increase prices?

Be the first to know

Sign up to our emails for brand new small business gift and homeware ideas, as well as the latest creative inspiration, delivered straight to your inbox.