Build a business

Hi, I'm Holly Tucker MBE, founder of Holly & Co and Notonthehighstreet. Having spent 20 years empowering over 100,000 small creative businesses to live their dreams, I truly believe anyone can turn their passion into a successful business they love. In fact, it's my life's work. Can I help you, too?

Let's get you started

business advice in bitesize chunks

Read 'How to start a business in 2025'

Listen to our popular podcast

Watch hours of free business advice

Sign up to my business emails

Join our small business community

Subscribe to our YouTube channel

Shop our small business supplies

Holly's top business advice

Articles to help you BEGIN

When's the right time to start a business?

How to find what you love in life and do it

The benefits of starting a business later

How to create a brilliant brand (& why it matters)

Running a business while raising the future

Small business networking: find your community

The steps to choosing your dream co-founder

Discover what makes an amazing product

Join our campaigns for small businesses

from supporting colour Friday, to Championing independents

Support the small business community

We love collaborating with businesses that give back to the small business community. Whether that's through sponsoring our podcast, partnering on campaigns or supporting our free business advice initiatives, meaningful partnerships help foster growth and connection, and give people a reason to support you too. We've partnered with Dell, Three, Royal Mail, NatWest and many more. Interested?

Expert business support in the UK (jargon-free)

SMALL BUSINESS ADVICE AND ENTREPRENEURIAL TIPS

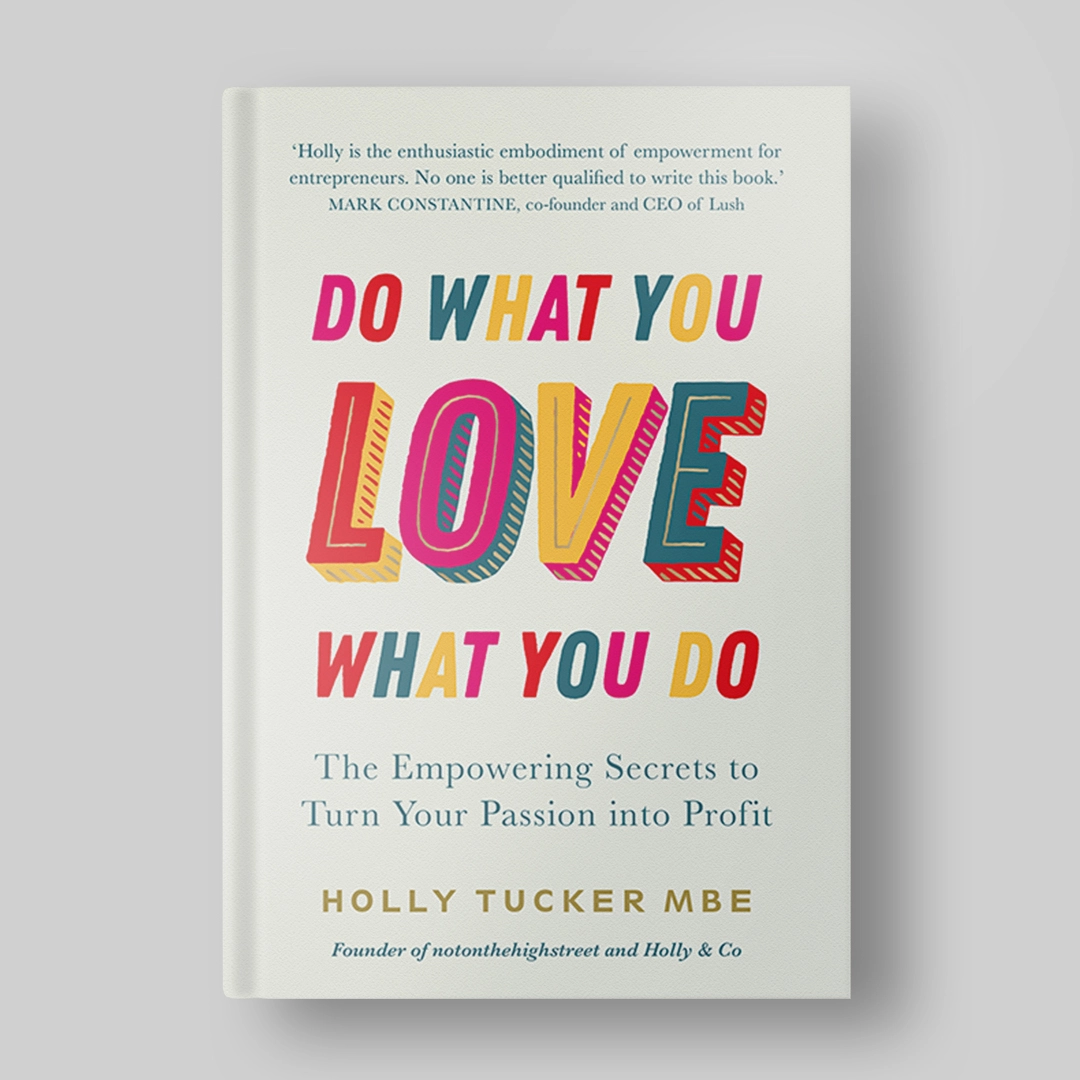

Business advice in the UK is easy enough to Google. But for free small business advice straight from leading founders and entrepreneurs who have been there and done it, come to Holly & Co. Holly Tucker MBE has been championing small businesses for decades and her book 'Do what you love, love what you do' was a Sunday Times bestseller. So from marketing and branding insights to business planning or confidence boosting, know that you’ve got a cheerleader in us.

Be the first to know

Sign up to our emails for brand new small business gift and homeware ideas, as well as the latest creative inspiration, delivered straight to your inbox.