How to grow your business with steady sales and make your income last year round

UPDATED 20TH AUGUST 2023

Planning and budgeting for the slow periods in your business? Managing cash flow and sales to save money during busy periods? It’s not easy. Read how to make your income last year round, and use the sales data and information you’ve got to your advantage...

Help, my sales are slow: how to manage small business finances

Wondering how to boost revenue when business is slow? Oh the panic. The dread. How many of you have looked at your orders one day to see a big fat ‘zero sales’ and felt that pit-of-your-stomach inkling that your company is actually… doomed? Why have your products suddenly become about as popular as our Government? How come it seems like there’s more chance of Elvis returning than customers? Where is your revenue hiding? Especially when during the pandemic, many small businesses were working every hour, juggling a million and one things to fulfil orders and there was almost *cringes* too much trade to handle?

Whether you’re facing this in January or June, we want to help you avoid the gut-wrenching agony of worrying about money. So, how can you do this? By planning ahead and innovating where needed (see our article ‘How to be innovative in business’ too, in case that helps). For example, naturally some businesses are seasonal by nature (advent calendars and picnic blankets, for example), yet most have more regular peaks and troughs of trading, as you’re probably well aware. So, how can we try to even it out? When the majority of sales fall within a short period of time, you need a way to stay afloat during the ‘off season’. So first things first…

Take a look back at your stock and sales data

If you don’t have historical stock and sales data, try to think of the times when you were crazy busy versus drumming your nails on your desk. If you’re a new business, look at what you know of your market and customers to help make predictions. COVID might have thrown a real spanner in the works in terms of trends but if you have been operating for longer, could you look at your sales data over a number of years to spot similarities and see if there is a pattern in your trading? If you don’t have this historic data (perhaps you launched during lockdown), analyse what did perform well in those early months and why it might have. Were you fulfilling a need that is no longer required? If so, what need can you fill now? Look at the market you are operating in, too…

- How do customers tend to shop within your market specifically?

- Has this changed as a result of external factors recently? For example, people holding onto their disposable income in this uncertain financial climate?

- Are there other life events occurring that would alter demand such as people suddenly holidaying abroad again?

- What are you noticing evolving in your own habits or what have friends and family mentioned? That’s often the best place to start.

We can never anticipate everything, but it’s worth doing your research regularly. Social media has made it easier than ever to gather a quick show of hands from your community, with the introduction of poll features, question boxes and so on. Use this resource.

Well this year, we can help you avoid joining the millions of people who’ll be in this exact same position. How? By planning ahead — and remembering that Christmas pudding really is just for Christmas.

Why is it so important to update your products?

Is your offering broad enough? Is there an opportunity to diversify? Do you have products that could work year round or if not, can you be more creative with your range to include some? How quickly can you move to jump on a trend or monumental moment (for example, those businesses that had the foresight to create a Jubilee product (or range even), or release something to celebrate the Lionesses historic win at Wembley)? Essentially, you just need to think if there is a way to provide an income not just in the spikes but in the dips too. This is where pivoting comes into play.

Think how many small businesses survived the pandemic thanks to speedy innovation. Always be prepared to shift the goalposts if you need to and remember that, sometimes it’s ok to place your perfectionist hat to one side and harness your entrepreneurial spirit to get the job done. It’s a golden opportunity to try something new and to test and learn, which can be invaluable.

What to do when sales are dropping? Understand your fixed costs

It’s super important to really understand your fixed costs. You need a clear idea of any outgoings or financial commitments that don’t fluctuate with sales, and have a plan for how you will cover these in quieter months (our article on why cash is queen lists some key actions and is a good place to start). Is there anything you can cut back on or outsource? Or do you have marketing and advertising up your sleeve for when you most need to attract customers?

The key is to consider what you will earn all year round and not just in the brighter times. Factor this in when calculating your pricing and margins, too. Never assume that if you’re riding a big wave of sales now, this will last forever. However miserable that sounds, remember the joy you’ll feel when you’re still swimming thanks to your clever prep — and reforecast if and when you need to. Also, think about your supply chain. Should you be amending the amount of stock you order? Or the amount of resources you need? People will appreciate as much notice as possible with these things, so giving prior warning will help you keep strong relationships going, too. The main thing to check is that you have enough cash to order stock for peak months even if you’ve not had the cash in sales. This means building up reserves so that you can dip into them in the quieter months and replenish them when you can.

Is your offering broad enough? Is there an opportunity to diversify? Do you have products that could work year round or if not, can you be more creative with your range to include some? Essentially, you just need to think if there is a way to provide an income not just in the spikes but in the dips too.

How small businesses can plan ahead

After a hectic period, you’ll be dying for a break and fair play (as mentioned in Holly’s article on ‘volume down’ time, we encourage founders to take some time to reset). But once you’ve had a rest, what can you get done now that your future self will thank you for? While your competitors are busy snoozing, think about what you can do in your quiet months that will help you further down the line. Is it packing up products ready for the next silly season? Working on your advertising to give customers a fresh reason to check you out? Encouraging them to order earlier?

Whatever you do, doing something is better than doing nothing. Planning for seasonality in advance, evening out your income and making good use of your quieter periods will stand you in good stead. So when you next look at your orders and they feel decidedly more icy than you might like, you won’t feel stuck out in the cold.

Growing your business with steady sales: key takeaways…

Here are the three main points to remember.

1. Ask yourself, “How do you use historical data to forecast demand and predict future trends?”

Look at the market you’re operating in too and work out what this might mean for your business.

2. Ask yourself, “How can you diversify your product offering and focus on business development?”

It might be time for some entrepreneurial innovation and that’s ok. It’s what you’re best at.

3. Ask yourself, “What should you do when your sales are dropping?”

Know your fixed costs and what finances you might have available to try to offset the dip with advertising and so on.

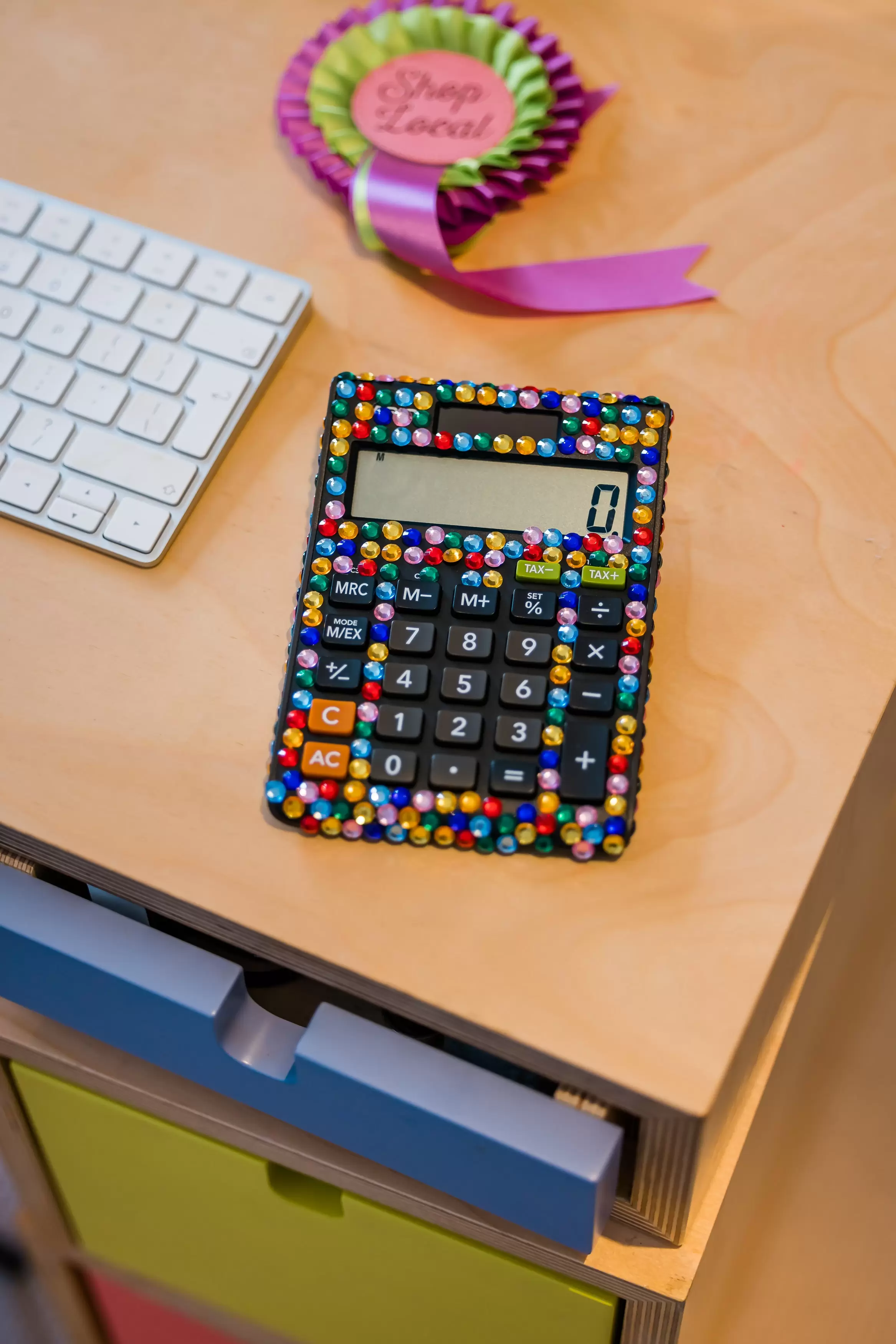

Images: Sparkly calculator — by Holly & Co, 'Pivot' flag — by Emma Giacalone, 'You've got this' coffee cup — by Team Holly & Co

Related content

MORE ARTICLES ON FINANCE, LEGAL & TECH

5 tips on choosing the right computer for your small business

The 5 pieces of equipment you (really) need when starting a small business

4 tech secrets every small business needs to know

How do I protect my designs from being copied?

What is a financial feminist? And why is finance a feminist act?

Simple tech tools, add-ons and gadgets to help small businesses

Be the first to know

Sign up to our emails for brand new small business gift and homeware ideas, as well as the latest creative inspiration, delivered straight to your inbox.