NEXT DROP 6TH MARCH 7AM. JOIN CLUB HOLL & CO FOR ACCESS

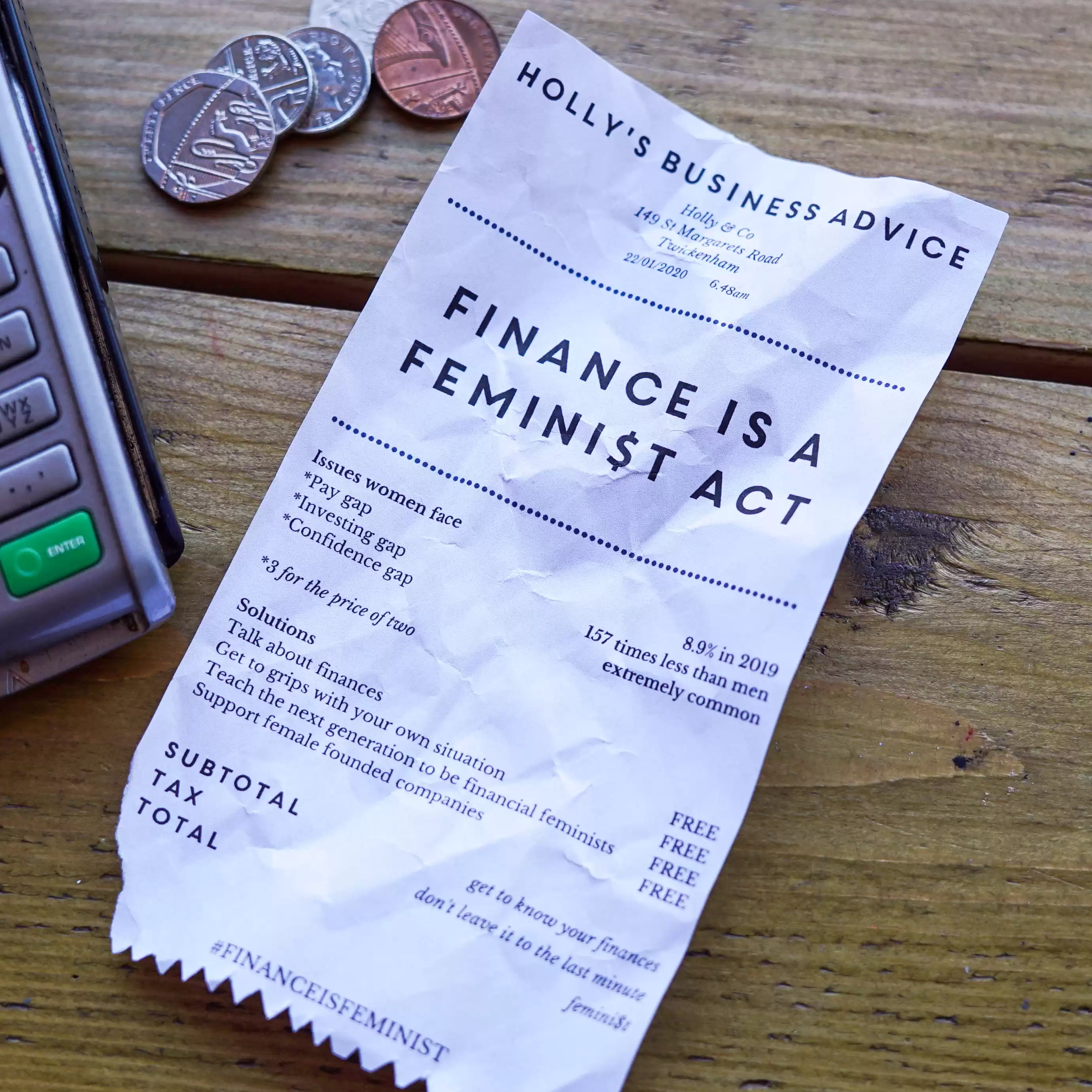

What is a financial feminist? And why is finance a feminist act?

Finance, legal & tech

By Holly Tucker

27TH AUGUST 2023

What is a financial feminist? It’s someone who believes in financial equality for women. Read on to find out why I think it is so fundamentally important for female founders to eradicate financial fear and stay in control of their own finances…

Why women need to learn about money

For decades (if not centuries) speaking up about money hasn’t been easy, especially for us women. Universally, we worry about how discussing the ‘M’ word might make us appear — too demanding, not demanding enough, overtly aggressive or sheepishly vulnerable — then often come to the conclusion that there’s no way to win as a female navigating her finances.

From negotiating rates of pay to tackling seed-funding investment, and eventually feeling so uneasy about pinning down our own personal accounts that we bury our heads in the sand for the foreseeable future, money talk can leave us overwhelmed. So incredibly overwhelmed in fact, that we’d rather just keep quiet and carry on. But I’m here to tell you that not only is allowing yourself an economic education an act of empowerment, it’s also near-enough-essential for self-care and self-preservation, too.

Here’s some business advice on how you can take your first steps in eradicating financial fear and claiming back the control you deserve. Financial liberation awaits!

How to take ownership of your business accounts

You’ll never know if you’re making the best decisions for your business if you don’t start owning what’s happening behind the scenes. Bite the bullet and get your finances in check — everything from monthly outgoings to staying on top of your VAT. Don’t be afraid to ask for help; a financial expert doesn’t have to be a regular spend. As Alice Gabb suggested when I spoke to her on her Conversations of Inspiration podcast episode, you can hire an accountant on a one-off fee simply for a hand with your annual tax return. With a weight off your mind and a greater understanding of the numbers, you’ll have a better scope of what your next move should be.

Finances don’t have to be frightening. Take one step at a time

Believe me, I have been there! Once I got into it, I realised I had used up too much precious time worrying and procrastinating about ‘getting on with my finances’ — much more time than the activity itself in fact. Here’s what I’ve learnt over the years…

I’m here to tell you that not only is allowing yourself an economic education an act of empowerment, it’s also near-enough-essential for self-care and self-preservation, too.

1. For financial independence, keep it simple and take it slow

If even a simple Excel spreadsheet fills you with fear, go back to a good old fashion cashbook. All we are really trying to do here is add up what comes in and what goes out, with a rough idea of where the money is coming from or where your spend is going to.

2. Set aside a regular time each week to go through your finances

And stick to it. An hour a week is so much easier than staring at a big bag full of receipts or a bank statement six months after the event trying to remember exactly what that spend was for. You’ll be surprised how quickly you grow in financial confidence.

3. Try to understand what the information is telling you

It might be ‘My spend is higher than expected, how come?’, ‘Is there any action I can take?’, ‘Am I on track with what I had planned?’, ‘Should I increase my prices?’ or ‘Do I need to change direction or take action?’ for example.

4. Use expert guidance from an accountant

As a founder, I know it can sometimes be hard to relinquish control. But it’s worth parting with some of your hard earned money to spend on, well… taking control of your money. Pay them to show you the ropes. It might well help save you money in the long run.

Once I got into it, I realised I had used up too much precious time worrying and procrastinating about ‘getting on with my finances’ — much more time than the activity itself in fact.

5. Challenge the way you speak to yourself about money

Sometimes, we’re our own harshest critics. The good news is, you probably already know more than you think! Remember, just because you’re a creative person, doesn’t mean that getting your numbers in order has to stifle your artistic mindset. Think of it as an extra string to your bow, and a way of keeping an eye on whatever your next big idea entails.

6. Establish your own financial goals, then make them happen

Although you may think you don’t have the faintest idea about finances, you are likely to be the best equipped to detail what you need from your money. Who else knows your business better?! From where you want to be in a year’s time, to highlighting the outgoings (and incomings!) associated with your plans, you’ll start to hone in on where you can save, and which areas need more financial input. You’ll be surprised how much money you could free up in one area, by tightening your belt in another.

Once you start breaking it down, nailing the business of all things numbers doesn’t have to feel like such a beast and it absolutely puts you in control.

Financial feminist: key takeaways…

Taking charge of your business’s finances and financial planning can save you money, grow your confidence and help you achieve financial equality. So don’t put it off. Start today. I wish you all the luck.

- Break your financial planning down into smaller tasks and take it slow

- Set time aside each week to go through your finances

- Don’t just get the data, take action from what it’s telling you

- Use an accountant to show you the basics of financial understanding

- Reframe the way you talk to yourself about money

- Outline your financial goals and keep these in mind

Related content

MORE ARTICLES ON FINANCE, LEGAL & TECH

How do I protect my designs from being copied?

Finance, legal & tech

How to grow your business with steady sales and make your income last year round

Finance, legal & tech

The cost of living impact on small businesses: should you increase prices?

Finance, legal & tech

7 cyber security tips on how to protect your business from hacking

Finance, legal & tech

4 tech secrets every small business needs to know

Finance, Legal & Tech

Simple tech tools, add-ons and gadgets to help small businesses

Finance, legal & tech

Laptops vs desktops: which are better for small businesses?

Finance, legal & tech

Be the first to know

Sign up to our emails for brand new small business magic and inspiration. And if you create an account, you’ll also get exclusive product drops, discounts and more from Club Holly & Co, too.