ARTWORK DROP NOW LIVE. JOIN CLUB HOLLY & CO FOR ACCESS

Ready for Holly's life-changing podcast?

HEAR Conversations of inspiration

Want to unlock the secret to what turned these unstoppable UK founders, brands and creatives into a household name? With over 200 episodes, a five star Apple rating and the most incredible 'Letters to my Younger Self' you've ever heard, these unique stories of passion, pain and perseverance are a must-listen for anyone who wants to find their path and do what they love.

The latest episode

Holly’s 2025 year in review

HOLLY & CO

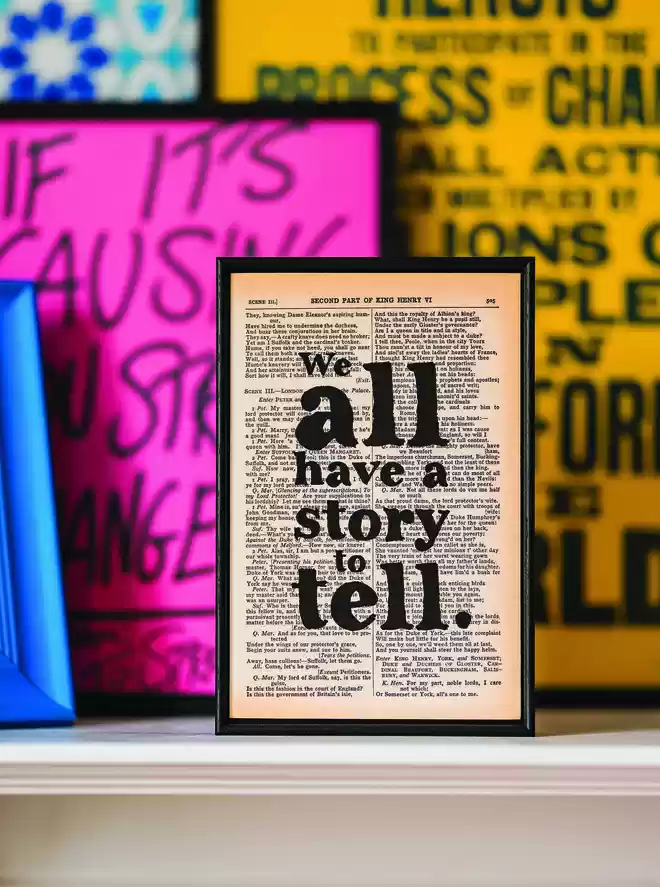

Holly reflects on a year of creativity, challenge and connection — from filming her first TV series to exploring AI in business. With wisdom from guests including Thea Green MBE, Vivien Wong and Katie Piper OBE, this uplifting episode celebrates the remarkable power of storytelling to bring us together.

Don't just take our word for it...

SEE WHAT OUR LISTENERS SAY

★★★★★

Refreshing, real, and encouraging

I'm not (yet...?) an entrepreneur, but I'm loving binge-listening to past episodes of this podcast. The shit that's now ongoing in the world of business, towards it being more acceptable to be a vulnerable and authentic human, particiularly for women, is SO GREAT to hear about from Holly and her guests..."

★★★★★

Can't get enough of this podcast!

"As a female small business owner who's on that rollercoaster that Holly so brilliantly understands, it's just so reassuring, interesting and inspiring to hear the challenges and successes of so many incredible entrepreneurs who've made it!"

★★★★★

This podcast can change your life!

"Such an inspiring and motivational listen. I highly recommend to everyone who loves to learn and consider different perspectives. Holly is a joy to listen to; her interview style is spot on - she makes you feel like you're listening to a friend."

★★★★★

Inspiration on tap

"Your podcast has been a real source of inspiration to me over the last few years whilst I manage the inevitable highs and lows of entrepreneurship.

Thank you so much for these uplifting and insightful conversations that I will continue to recommend far and wide.... Thank you!"

★★★★★

A must-listen

"Holly's Conversations of Inspiration are joyful. Stories of triumph over adversity, strength, grit, determination and resilience are inspiring for entrepreneurs and those curious about the thinking behind brands."

★★★★★

Truly inspiring

"This show is definitely the most inspiring and incredible podcast series!

Really love Holly's way of interviewing the guests and the younger self letter part always makes me cry!"

★★★★★

Brilliant and Inspiring Podcast

"What a refreshingly honest and raw podcast. Utterly brilliant. I have had so many moments where I have connected with what has been said and make me really think about my own experiences.

Thank you Holly. X"

Discover our collections

Iconic Brands

The surprising stories behind the household names

Wisdom & Experience

Golden advice and insight that only comes with age

Empowering Women

Inspiring life lessons from phenomenal females

Neurodivergent Thinking

Celebrating original ideas from original thinkers

Social Purpose

Brilliant lessons from those championing change

The Artisans

The craftspeople making a living using their hands

Triumph Over Adversity

Remarkable stories of unparalleled strength and grit

Most Listened To

Our followers’ favourite Conversations of Inspiration

Be the first to know

Sign up to our emails for brand new small business magic and inspiration. And if you create an account, you’ll also get exclusive product drops, discounts and more from Club Holly & Co, too.